A Biased View of The Wallace Insurance Agency

The Wallace Insurance Agency for Beginners

Table of ContentsSome Known Details About The Wallace Insurance Agency The Wallace Insurance Agency - QuestionsThe 5-Second Trick For The Wallace Insurance AgencyLittle Known Questions About The Wallace Insurance Agency.Rumored Buzz on The Wallace Insurance Agency

Like term life insurance policy, entire life plans offer a survivor benefit and other advantages that we'll get involved in later on. But they have a vital difference: A whole life policy never runs out. The primary benefit of a whole life plan is that it develops money worth. A part of each costs settlement you make is done away with in a different account that can be spent or accessed with a car loan.The distinction is that it offers the policy proprietor far more versatility in terms of their costs and cash money worth. Whereas a term or whole life plan secure your price, an universal plan enables you to pay what you have the ability to or wish to with each costs. It also allows you to change your death advantage during the plan, which can't be performed with other sorts of life insurance policy.

If you have dependents, such as children, a spouse, or parents you're caring for and do not have substantial wide range it may be in your ideal rate of interest to buy a plan also if you are relatively young. https://www.indiegogo.com/individuals/35879925. Should anything occur to you, you have the comfort to recognize that you'll leave your loved ones with the financial ways to work out any type of remaining costs, cover the prices of a funeral service, and have some cash left over for the future

The Wallace Insurance Agency for Beginners

Motorcyclists are optional modifications that you can make to your plan to boost your insurance coverage and fit your requirements. If a policy owner needs funds to cover lasting care costs, this rider, when turned on, will offer monthly repayments to cover those expenses. This rider can waive costs after that occasion so coverage is not shed if the policy proprietor can not pay the month-to-month costs of their policy.

Automobile insurance policy pays for protected losses after an accident or incident, securing versus possible economic loss. Depending on your coverage, a policy can protect you and your travelers. The majority of states require chauffeurs to have vehicle insurance policy protection.

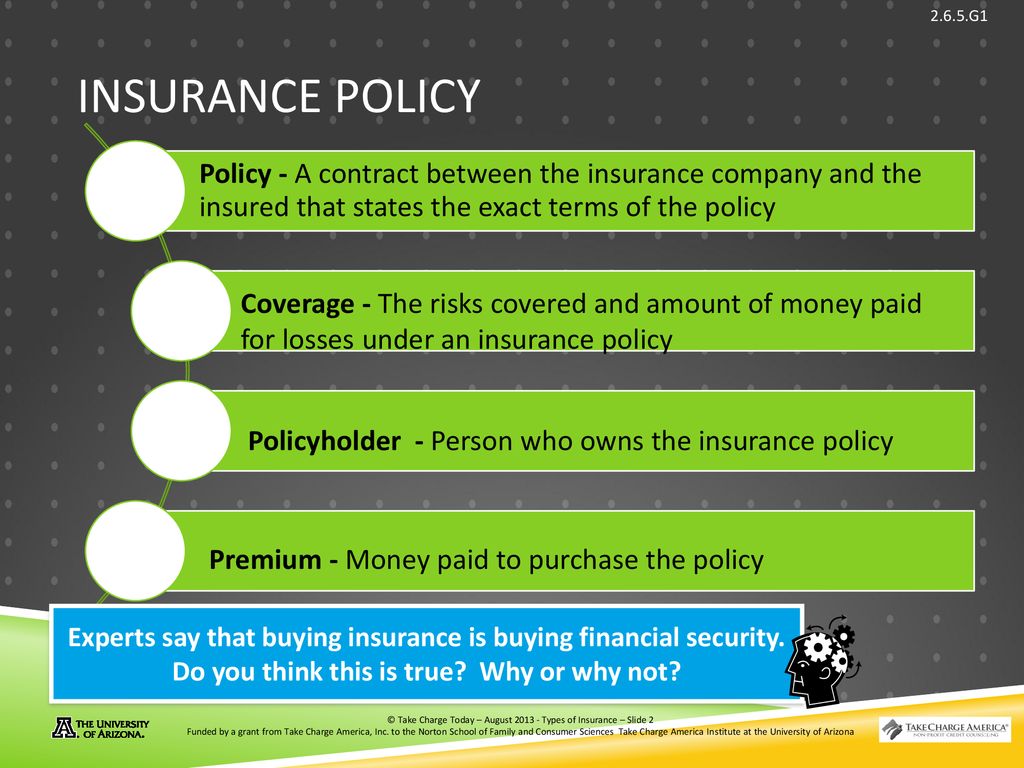

There are numerous types of insurance policy items like life insurance strategies, term insurance coverage, wellness insurance coverage, home insurance coverage and more. The core of any insurance coverage plan is to offer you with protection (Liability insurance).

The Only Guide for The Wallace Insurance Agency

In addition to the life cover, they additionally provide maturation benefit, resulting in an excellent financial savings corpus for the future. A treasured property like your auto or bike additionally needs protection in the form of vehicle insurance in order to guard you from expense expenditures in the direction of it fixings or uneventful loss.

This is where a term insurance strategy comes in helpful. Safeguard the future of your household and purchase a term insurance coverage policy that blog will certainly assist your nominee or reliant get a swelling amount or monthly payment to help them deal with their monetary requirements.

The Main Principles Of The Wallace Insurance Agency

Live a calm life and handle your risks that you can deal with in daily life. Safeguard your life with insurance and make sure that you live your life tension-free. With increasing medical prices, medical insurance is mandatory to hold. Safeguard you and your household with the protection of your health insurance that will certainly give for your healthcare prices.

Life insurance plans and term insurance policy policies are very imperative to safeguard the future of your household, in your absence. Life insurance policy prepares helps with systematic savings by designating funds in the type of costs every year.

Insurance policy encourages cost savings by decreasing your expenses in the future. You can avoid expense payments for unfortunate occasions like clinical disorders, loss of your bike, crashes and more. It is also a wonderful tax conserving tool that aids you decrease your tax burden. Insurance policy attends to a reliable danger monitoring in life.